Publishers Clearing House Scam: How To Spot it & What To Do

- Daniel Fayoyin

- Jan 21

- 11 min read

If you are on this page, one of three things is likely.

You have received contact from someone claiming to be from Publishers Clearing House informing you that you have won a prize.

You have received an unexpected check in the mail which seems to be from Publishers Clearing House. The check comes with a notification telling you that you have won a prize and provides instructions on how to deposit the check and you are wondering what to do next.

You are a very curious lady or fellow and your thirst for knowledge has led you down the rabbit hole of unorthodox lottery scams.

For each of you cohorts. Fret not! No Scam will arm you with the knowledge you need to understand what is going on and take the right course of action going forward.

Quick answer: Publishers Clearing House does not notify winners by phone or social media. You never have to pay to receive a prize. Always contact Publishers Clearing House by yourself at their designated phone number 1-800-392-4190. If you were contacted unexpectedly or asked to follow instructions — it is a scam. PCH never requires payment, bank details, or advance fees to claim prizes.

Is Publishers Clearing House Legit or a Scam?

Publishers Clearing House is legitimate — but scammers frequently impersonate it.

It was founded in the 50’s as a direct mail magazine subscription service and 14 years later in 1967, started its first sweepstakes as a way to increase subscription sales. To date, Publishers Clearing House (PCH) has given away up to half a billion dollars in winnings and is recognized as an established player in the sweepstakes and giveaway landscape.

It is precisely this success, high legitimacy and trust, that scammers use to conduct one the most tried and true scam business models out there. Namely, the age-old lottery scam. The Publishers Clearing House scam is simply a variety of this category and later in this article, we will show you a specific example of this scam which has been making its rounds on this side of the Atlantic.

First, let’s break down what to do when you receive unsolicited contact from someone claiming to be from Publishers Clearing House or when you receive an unexpected check in the mail.

To understand this situation, it boils down to understanding exactly how Publishers Clearing House conducts its giveaways, and to do this, we will answer the when and where of the communication channels that PCH uses.

Communication Channel | Contacted for prizes | Situation |

Social Media | NEVER | NEVER |

Telephone | NEVER | NEVER |

SOMETIMES | Online giveaways only | |

Direct Mail | SOMETIMES | Offline sweepstakes |

In Person Visit | Yes (> 10,000) | Prize patrol. Large sums |

What To Do If You're Contacted About a PCH Prize

Phone Call or Social Media Message

This is a scam. Act Immediately.

Publishers Clearing House will never contact you by phone or social media about prizes

Hang up or stop responding immediately

Do not continue the conversation "out of curiosity"

Do not share any personal information.

Why: Scammers are masters of situational awareness and manipulation. The longer you speak with one, the more information they gather about potential angles they can use to make you part with your money. This is their job, they do this for a living, so even if you have any ideas that you could “outsmart” them. The more likely outcome is that you give them a treasure trove of information that they will, either now, or eventually be able to use against you.

Email claiming you've won a prize

Depends on one question. Did you enter?

If you did not enter an online PCH giveaway

This is a scam

Do nothing and delete the email

If you did enter an online PCH giveaway

Do not replay to the email

Contact PCH yourself at 1-800-392-4190 to verify

Important: Email notifications apply only to online giveaways you knowingly entered

Unexpected check in the mail

Treat this as suspicious by default

PCH notifies winners before sending a check

If you received a check without prior notification:

Do not deposit it

Contact PCH directly at 1-800-392-4190

Why: Unexpected checks paired with instructions are a common entry point into scam extraction funnels. In scams, what the scammer wants is for you to be in a situation where you start to blindly follow their instructions. This is because they need you to take the actions that will lead to you parting with your money. This is why scams aren’t technically theft. You are the one that performs the steps that lead to the loss of your money. These funnels are expertly designed and backed up by data over the thousands of scams they have run, to craft a truly optimized funnel that ends with you parting with your money. The best way to protect yourself and your funds from an extraction funnel is to make sure that you never get inside one! When you contact PCH directly for verification and delivery, you side step the scamming mechanism. You side step the funnel. If you want a real life example of a scam extraction funnel you can read our brushing scam article.

Requests for taxes or special instructions

This is always a scam

You will never need to pay money to receive a PCH prize

You will never be asked for:

Bank account details

Social security number

Advance fees or "processing costs"

What PCH actually requires

Name

Date of birth

Address

Email Address

A notarized sweepstakes affidavit

If the "prize" comes with step by step instructions, special contact, or urgency - you are likely entering a scammers extraction funnel.

In-person visit

More likely legitimate - still verify

Real PCH visits typically include:

Prize patrol

A large check

A film crew

These are difficult to fake

Even then

After the visit. Contact PCH directly to verify.

Verification is always safer than assumption

🔑 The golden rule

Never follow instructions provided in an unsolicited message. Always verify independently using contact details you trust.

Calling PCH yourself may take longer — but it keeps you in control and keeps scammers out of the loop entirely.

Help Others Avoid This

Before we go deeper, we’re collecting anonymized insights to help prevent scams — not just for you, but for others as well. If you’ve encountered a situation like this, answering the question below helps turn individual experiences into shared protection. There’s no right or wrong answer.

When you received the message described above, which of the following did you do first? (Select the closest option)

I independently searched for information using my own source

I contacted the organization using contact details I trusted

I followed the instructions provided in the message

I asked a friend or family member for their opinion

Why Lottery Scams Work

Now, that said. In traditional NoScam fashion, let’s dive deeper to understand what is actually going on behind these scams. As mentioned in the introduction the PCH scam is a form of a lottery scam and these aren’t new. PCH doesn’t exist in Europe, but that doesn’t mean the scammers will be deterred. Below, you will find a real example of a lottery scam email that was received by one of the friends of NoScam. No less than a month ago.

This Isn’t an Isolated Case

Instead of PCH, the scammers are claiming to be from an online German lottery and my friend was informed that he received the juicy sum of 2.5 million euros. Bear in mind that this “online German lottery” is using a .co.uk email address. As with the PCH scam, this email also comes with instructions on who to contact about how to receive the money. Making contact here is the point where one enters the scammers extraction funnel. If we believed this email to be accurate. The correct choice of action would be to find the online German lottery organization themselves, verify the prize and thereafter initiate the process to receive it. For the readers’ information, there is no such organization called the “online German lottery”. This is an ambiguous umbrella term that they use which could plausibly fit any one of the various organizations that run lotteries online in Germany.

Now, although we here at NoScam didn’t fall for this low level exploit. This is a good point to think about why these scams are so prevalent, and why they actually work. We will show you the conventional psychological understanding of why people fall for these scams and provide NoScam’s unique perspective which we argue reveals a deeper understanding.

The Psychology Behind Lottery Scams

Systemic Biases in Decision-Making

The common way psychology and behavioral economics explains why scams works is that scammers prey on systemic biases. Systemic biases are mental shortcuts (heuristics). Shortcuts that usually help us make quick decisions, but can lead us astray in low probability high reward situations.

Prospect Theory and Asymmetric Risk Evaluation

Using the findings of Prospect Theory, Kahneman & Tversky were able to establish and demonstrate that:

People don’t value gains and losses symmetrically - Small probabilities of large gains are often over weighted in decision making

Asymmetric risk evaluation is what makes a low probability lottery win seem more attractive than it actually is. The asymmetric nature of our estimations is what leads us to take risks and course of actions that probably aren't rational but which we are willing to take a chance on. You can essentially call it hope, and in a world where things are hard and things feel scary, hope is what keeps us going! Scammers create fake situations that trigger our hope and our desire for something to be true, knowing full well that there is a structural psychological bias in our evaluation mechanism. This is what makes scams like this a positive expected value play.

The Simulation Heuristic

Secondly Kahneman's findings were also able to demonstrate that we as humans employ a simulation heuristic when we make decisions.

People judge likelihood based on how easily they can imagine an outcome. Vivid scenarios feel more probable.

So now, picture this. You’ve been having an average to slightly below average day, acutely sensitive and kind of irked by the mundanity of the cycle you repeat that we call life. Out of somewhere you receive a check in the mail telling you that you’ve won. Or an email or direct mail, maybe even someone calling you and telling you that you just received a large sum. In that situation, even if we don’t respond to the email, many of us will at least start to imagine what we could do with money like that. It's like asking you not to think of a pink elephant. As we can see here, the key difference between whether or not we get scammed in such a situation can literally boil down to something as trivial as whether we deleted the email before we started to imagine the “possibilities”.

The Overconfidence Effect

A further cognitive bias that makes us susceptible to these scams and hence why they keep happening is actually a paradoxical one. Namely, the overconfidence effect.

The overconfidence effect is a cognitive bias in which a person’s subjective confidence in their judgements is reliably greater than the objective accuracy of those judgements. Especially when confidence is relatively high.

The overconfidence effect is why 80% of drivers think they are good drivers. Or “better than average” drivers. It is mathematically impossible for 80% of drivers to be better than 50% of drivers. But because we all drive so much and it is something we all have experience in, we become over confident in our judgments. The reason why this is so important for scams is that, scams that target certain professions are more likely to work on people that have experience in that profession or area. Hence, the real estate agent is more likely to fall for a housing / real estate sale scam than the average person. The same for the crypto bros, yes, they were making a lot of money from their investments but they were also losing some of it to scams. They had experience in the area which led to overconfidence which made them a honey pot for certain scammers. So if you already have experience winning lotteries and prizes, please be extra careful going forward. Your psychology could easily betray you.

Thinking fast and slow in Scam Situations

To tie all of this together, the framework that most psychologists use is what is called dual process theory. Dual process theory is a psychological framework that explains human thinking as an interaction between two different modes of cognition - fast/intuitive (system 1) and slow/deliberate (system 2).

System 1 is said to operate: quickly, automatically and with little conscious effort. It is responsible for gut feelings, pattern recognition, emotional reactions, snap judgements and heuristics. The shortcuts we described above. System 2 is described as operating: slowly, consciously and with effort. It is responsible for logical reasoning, probability calculation, fact checking and reviewing and evaluation. In the Publishers Clearing House scam and other lottery scams, the conventional understanding is that system 1 activates first, we view a large potential reward, we imagine emotionally about what could be done with the money, we see a familiar brand name we can trust, and there is hope and urgency. Because, system 2 is lazy and doesn't usually enter a situation unless forced. The probabilities in the situation seem abstract, red flags aren’t processed and the cost of “just trying" seems small. Therefore, we act before system 2 takes control and we fall for the scam.

Why this explanation is incomplete

Together prospect theory and dual process theory can give us some insight as to why we fall for scams and what makes them so prevalent. Prospect theory explains what we misjudge (via heuristics), and dual process theory explains why/how the misjudgement happens (via system 1 dominating before system 2 can take over).

All of this is true! However, at NoScam, we would like to add an extra layer of insight to put your heart at ease and show you why it's not so simple and why you don’t need to feel bad for falling for scams.

Trust, Framing, and Epistemic Capture

Why Rational Thinking Isn’t Enough

What the traditional psychological explanation does is that it frames the solution as saying that: “if only system 2 had kicked in, the scam wouldn’t have worked”. That is an incomplete story. Dual process theory is often interpreted as system 1 = bad and system 2 = good. This is a misguided understanding, because there are situations where even when the person is thinking rationally, and evaluating the situation based on information they believe to be correct, they can still fall for the scam. There is also the issue of trust. In the sense that, once you trust a person, you are more likely to believe their framing, which leads you to make a decision that you think is correct, but ultimately self-defeating.

Rationality Depends on Trustworthy Inputs

System 2 reasons over inputs. If the inputs are manipulated, rational reasoning even without heuristics can still produce the wrong conclusion. So a person can be calm, deliberate and reflective, and still make a disastrous decision. Being scammed is not a failure of your reasoning! It is a failure of epistemic grounding. Rationality ≠ truth. A person can reason logically, follow coherent steps, weigh the costs and benefits. Yet, that person can still be wrong if the information source is false, the framing is deceptive and the truth has been misplaced. This is exactly what a scam is. So it's not your fault if you fall for one and it is not a failure of your reasoning. It’s more that we trust a situation and trust is not irrational. Without trust, modern society collapses. Psychologically, trust functions as a complexity reduction mechanism, a substitute for full verification and a signal that someone has done the checking. Scams don’t just present false facts, - they present a coherent narrative. If we accept this narrative and frame, we think along the lines of:

This is a legitimate authority

This person is helping me

This is how prizes work

How Scams Hijack Trust Through Framing

If system 2 accepts that frame, it then becomes “logical” that we need to pay someone to receive our prize. Even though this is the exact signal that something is wrong. From within the frame that choice is rational. So if you have been scammed it is not per se, that you were stupid or irrational, but more likely that you were too trusting. That's the key difference. Scammers win when our thinking is gradually redirected to operate in a trust based false frame and we as a society need to understand this and normalize being scammed or almost scammed. You were not stupid, you were not low IQ, you were not “tired”. Your mental frame and rational processes were hijacked by professionals who have developed and optimized processes to do exactly that.

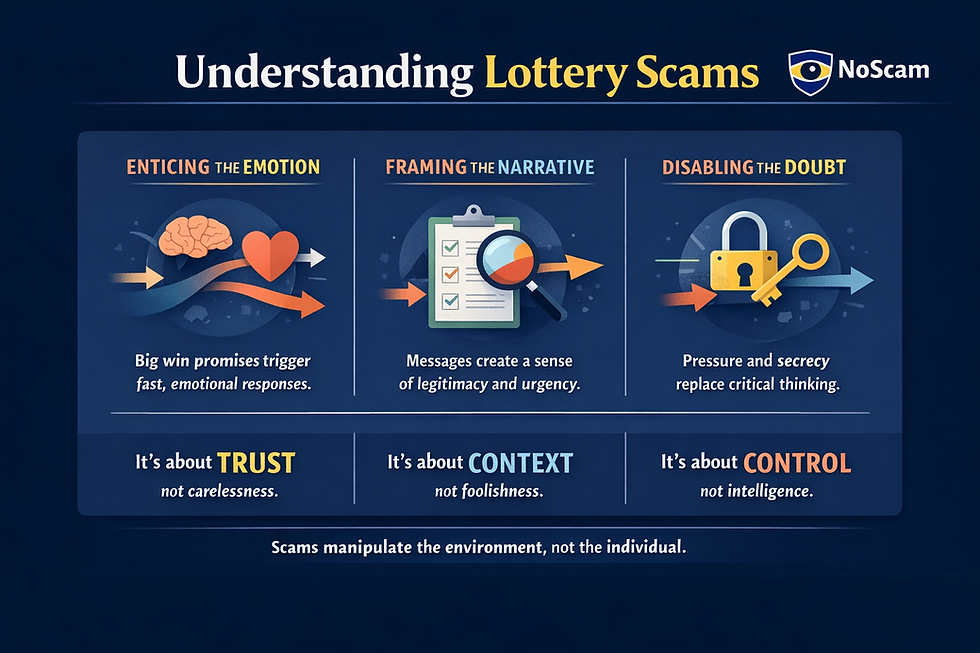

Summary: What to Take Away

Lottery scams don’t work because people stop thinking. They work because thinking happens inside environments that feel trustworthy, coherent, and meaningful.

Psychology shows that we systematically misjudge rare, high-reward situations, that fast emotional reactions often precede careful reasoning, and that even deliberate, rational thinking can fail when it operates on false or manipulated information. Scams exploit these features deliberately — not as accidents, but as design choices.

This is why falling for a scam is not a failure of intelligence or character. Trust is not irrational; it’s a necessary shortcut that allows modern life to function at all. Scammers succeed by hijacking that trust and replacing independent verification with a convincing narrative that feels internally logical.

Understanding this doesn’t just help prevent scams in the future. It removes shame from having encountered one in the past. What failed wasn’t your ability to think — it was the frame you were asked to think inside.

If this helped you understand what happened, we’ve distilled the core idea into a short visual you can share with others.

Scams manipulate context and trust — not intelligence.

If you’ve experienced something similar and want to share it, you can do so anonymously.

Stories help us identify patterns and turn individual experiences into shared protection — but there’s no obligation.

Comments